The Of Vancouver Tax Accounting Company

Wiki Article

6 Easy Facts About Tax Accountant In Vancouver, Bc Explained

Table of Contents4 Simple Techniques For Pivot Advantage Accounting And Advisory Inc. In VancouverSome Known Factual Statements About Vancouver Accounting Firm All about Cfo Company VancouverSmall Business Accountant Vancouver Fundamentals ExplainedThe smart Trick of Vancouver Accounting Firm That Nobody is DiscussingPivot Advantage Accounting And Advisory Inc. In Vancouver Can Be Fun For Everyone

Below are some advantages to working with an accountant over an accountant: An accountant can provide you a detailed sight of your service's monetary state, along with approaches and also suggestions for making financial choices. Accountants are just liable for tape-recording economic deals. Accountants are required to complete even more education, certifications and also work experience than bookkeepers.

It can be challenging to gauge the ideal time to work with an accounting expert or bookkeeper or to figure out if you need one at all. While several small companies employ an accounting professional as a specialist, you have numerous choices for managing financial tasks. Some little service owners do their very own accounting on software application their accounting professional suggests or makes use of, supplying it to the accounting professional on a weekly, month-to-month or quarterly basis for action.

It might take some background research to discover an ideal accountant since, unlike accountants, they are not called for to hold a professional accreditation. A strong endorsement from a trusted associate or years of experience are vital variables when working with a bookkeeper. Are you still unsure if you need to employ somebody to aid with your books? Below are three instances that indicate it's time to hire an economic professional: If your taxes have actually ended up being also complicated to take care of by yourself, with numerous revenue streams, foreign financial investments, a number of deductions or various other factors to consider, it's time to work with an accountant.

Vancouver Tax Accounting Company Things To Know Before You Get This

For local business, proficient cash money monitoring is a vital element of survival and development, so it's smart to collaborate with an economic specialist from the beginning. If you like to go it alone, think about beginning out with bookkeeping software program as well as maintaining your publications meticulously up to date. That means, must you need to employ an expert down the line, they will have visibility into the total economic background of your company.

Some resource interviews were performed for a previous variation of this short article.

Pivot Advantage Accounting And Advisory Inc. In Vancouver - Questions

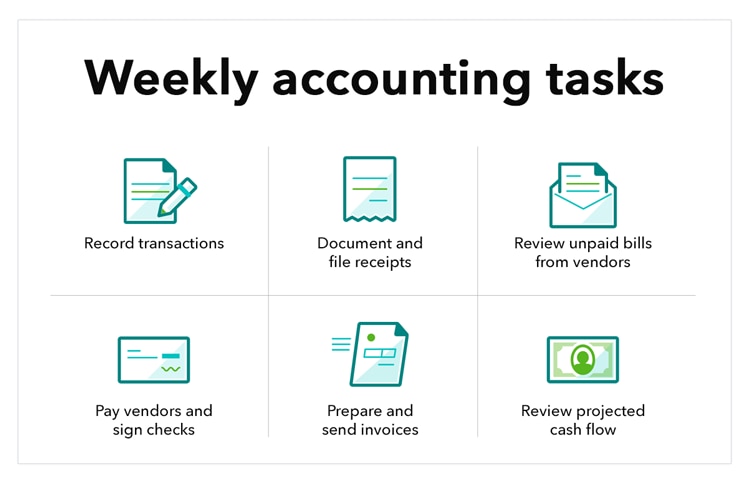

When it involves the ins and outs of tax obligations, accounting as well as money, nevertheless, it never ever hurts to have an experienced professional to look to for support. An expanding variety of accounting professionals are likewise caring for points such as capital projections, invoicing as well as human resources. Inevitably, much of them are handling CFO-like functions.Local business proprietors can expect their accounting professionals to aid with: Picking business structure that's right for you is very important. It impacts just how much you pay in tax obligations, the documentation you need to file and also your personal responsibility. If you're seeking to convert to a various business structure, it can cause tax obligation repercussions as well as various other problems.

Even firms that coincide dimension and industry pay very various quantities for accounting. Before we enter into dollar numbers, let's discuss the expenditures that go into small company accounting. Overhead expenses are costs that do not directly become an earnings. These expenses do not transform right into money, they are required for running your company.

Examine This Report on Tax Accountant In Vancouver, Bc

The ordinary expense of accounting solutions for small organization differs for each and every unique circumstance. Because accountants do less-involved tasks, their prices are often more affordable than accountants. Your financial service cost depends on the job you require to be done. The average monthly audit charges for a small company will certainly rise as you include a lot more services and the tasks get tougher.For instance, you can videotape purchases and process payroll utilizing on the internet software. You enter quantities into the software application, and also the program computes overalls for you. In some situations, payroll software for accounting professionals allows your accounting professional to use payroll handling for you at really little added price. Software application solutions are available in all shapes and sizes.

The Buzz on Vancouver Tax Accounting Company

If you're a brand-new company owner, do not neglect to factor accounting expenses right into your budget plan. If you're a professional owner, it may be time to re-evaluate accounting prices. Management prices and also accountant costs aren't the only accountancy expenditures. tax accountant in Vancouver, BC. You should additionally consider the impacts accounting will carry you as well as your time.Your capability to lead staff members, serve customers, as well as choose can endure. Your time is also important and also need to be thought about when looking at accounting expenses. The moment invested on bookkeeping tasks does not produce revenue. The less time you invest in accounting and also tax obligations, the even more time you need to grow your business.

This is not intended as lawful guidance; for additional information, please visit this site..

Excitement About Outsourced Cfo Services

Report this wiki page